If you’ve read the FAQ below and still have an unanswered question, you’re probably not the only one with that question. We’d love to update this page accordingly, it will help other readers as well.

So please, share your question with us using the contact form, or if you prefer as a comment below (which we will not approve, but instead update the FAQ according to it).

Which type of questions are on your mind?

General Questions

Who are you, StatsTrade?

We are a group of experienced researchers, studying people’s behavior in and outside of the markets. We like what we do. You may read more about us or contact us for any inquiry or feedback.

So… you can predict where the markets are going?

Noone can predict the future. Even the brightest analysts usually add many disclaimers to their so-called “predictions”. There’s only one reality, and one future.

But you do generate some predictions, right?

Again, we are no fortune-tellers. However, we are proficient in the arts of mathematics, statistics, financial trading, research methodologies and more. Oh, and we also like to think that general creativity is a serious advantage in this exciting field. Our primary objectives are research-oriented. As a very nice byproduct, we have our Insights services. Read more here.

How may I access those Insights?

As of 2012, Nate‘s Insights are shared with the general public. Nate‘s analysis is confined in many senses, but nonetheless this free service beats the competitors’ paid alternatives. You are more than welcome to test it yourself. Sign up to the Free Newsletter and evaluate Nate’s performance over time.

As of 2012, the more professional Insights (with all due respect to our beloved Nate) are shared only with a selected group of Partners, and not with the general public.

I’ve seen many other companies and services on the Web that offer stocks recommendations. What makes you better?

We believe we have a strong research foundation, unique skills and goals. But it doesn’t matter what we believe. It’s your money. We can only urge you to do your homework. We tried to make it easier for you, though: There’s our Free Newsletter where you gain access to Nate‘s analysis results. Compare his performance with our competitors. After a month or two you’ll hopefully come to the following conclusion: If Nate himself outperforms the competitors, I’m ready for (and curious to test) that Partners-only service they talk about…

There’s also something else that distinguishes us from others. Unlike other systems, our core research framework was (and still is) designed with purely research-oriented agenda in mind. We study the way people behave in the markets, to deduce insights on the markets and people behavior in general. The StatsTrade Insights service is “merely” a byproduct of the original goal. In contrast, other systems might first state their goal to be “to generate some stocks predictions” and thereby limit their work to be exactly that, disregarding the important hidden factors along the way. This difference in the “attitude” makes a big difference. We know.

How may I follow you?

Indeed, the site and services are undergoing important changes. You should follow us on Twitter and on Facebook for some important updates!

More on Analysts

Some say that analysts are essentially effective as… well, monkeys. Or a random coin toss. What do you think about that?

In a field with such a low barrier to entry, anyone can “analyze” the market, come up with some “analysis result” and possibly write an occassional blog post about it, emphasizing his/her past success. Most of the times don’t even take the bother to discuss the issue in a well-defined manner. Therefore it’s only natural that the majority of “analysts” are essentially making random guesses.

That’s the world we live in. We could try to convince you that we know what we’re talking about, but others might have more convincing web designers. 🙂 That’s why we’ve decided to open our gates, in the form of a Free Newsletter, to grant you access to Nate‘s analysis results. This way you can do your own homework (trade responsibly!) and see for yourself, how even our free service outperforms the competitors’ paid alternatives.

What about my bank’s advisers? They offer me their advisers for free! Why should I use you?

You may listen to your bank’s adviser. It may be interesting to hear what she thinks. It’s usually free, and only requires you to sign something similar to the terms for using our site. So what is the difference?

The bank’s adviser is, well, the bank’s adviser. She’s the adviser of the bank. That’s where her interests are at. She might be interested in encouraging you to making more transactions, so that the bank would enjoy the commissions. Alternatively, she may simply be interested in showing empathy and concern for the bank’s client, just to keep him a happy client. All in all, her interests are not in making accurate and independent analysis results for you. She does not bother to report on her past performance. She will not analyze a lot of data before making up her mind.

To conclude — you may freely listen to the bank’s adviser, if you seek empathy or insights into the bank’s interests. Otherwise, you should do your own research, and/or consult some independent and professional research group to assist you in your decision making process.

I prefer my common sense, or “hunch”, or super-natural unique gift to identify good stocks.

Common sense is not that common. If you’re one of the few who have it, use it!

A “hunch” may be very dangerous, but we will never tell you what to do with your own money (although the least we can do is beg you again and again to trade responsibly).

Lastly, if you have a super-natural unique gift to identify good investments, good for you! See our previous sentence, and we may only offer our services to possibly suggest a few more insights or interesting analysis results.

It’s your money. You’re the boss.

Excellent question, that should be asked every time someone offers you such a service! (Try it on your bank adviser…)

In our case, the answer is very simple: We do use our analysis results. We have been using them for years. Not only Nate‘s results, that are publicly available to the free subscribers, but the complete deal — the one shared only with our selected group of Partners.

That’s why we:

- Tend to share analysis results related to companies with large market capitalization, so that our (and our Partners’) trading actions won’t dramatically affect the share price.

- Monitor and try to estimate the possible effects such actions have on share prices.

- Share our complete analysis results only with a limited group of Partners. In some sense, the Partners Program is just one big experiment, whose number of participants is carefully limited.

- (But the real and short answer is actually:) We personally believe that we’re better than our competitors. Heck, we believe that even our free version is better than their paid versions. That’s why we give you (for now) the opportunity to test Nate‘s work via our Free Newsletter, hoping that after a month or two you’ll come to the following conclusion: If Nate himself outperforms the competitors, I’m ready for (and curious to test) that Partners-only service they talk about…

Lastly, keep in mind that our primary goals are research-oriented. We’re not here to scam anyone, and we expect the same level of loyalty from our Partners. See our terms! We reserve the right to modify (or even completely shut down) the Partners Program or the Free Newsletter in the future. We also reserve the right to refuse to serve users who are commercially-affiliated, act suspiciously, or otherwise endanger our work in our sole and absolute opinion.

Questions about the Free Newsletter

How to interpret the numbers in the Free Newsletter?

The Free Newsletter provides a preview into some of Nate‘s analysis results. The full Insights from Nate and the other Robot-Analysts are available only to a selected group of Partners.

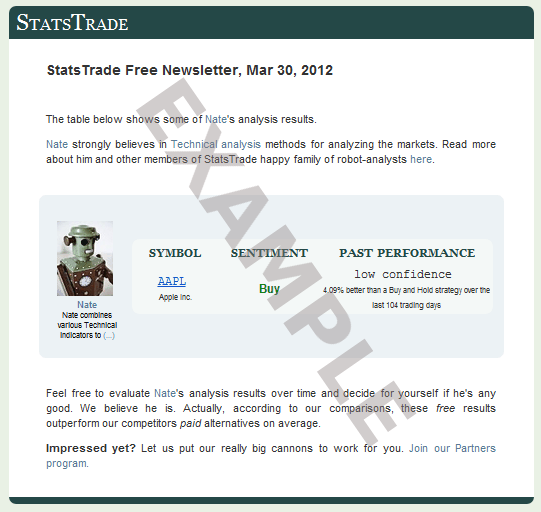

In the Free Newsletter, Nate summarizes his sentiment on a few stocks in a neat table. For example (see the example image), a “BUY” sentiment on the “AAPL” stock means that, according to past data, Nate believes that Apple’s stock is going up.

The past performance column consolidates further data to elaborate on that sentiment, including:

- How confident is Nate in today’s sentiment? (according to historical evaluation, the more confident Nate was at a specific point in time, the more successful his analysis was at that time on that stock)

- What absolute gain/loss did Nate’s strategy had over that period?

- If we were to simulate at hindsight all of Nate’s sentiments on this stock, how would this strategy perform when compared to a simple Buy and Hold strategy over that period? In our example, following Nate’s strategy on Apple’s stock would have given us a better return (4.09% better) than that of a simple Buy and Hold: If the stock price has multiplied by X on that period, then Nate’s strategy would have given a better return of X*(1.0409). For example, if Buy and Hold gave a return of +10%, following Nate’s strategy would result with an absolute return of +14.499%.

How do you choose which companies to analyze each day?

We analyze a lot of data each day, including a lot of companies data. The Free Newsletter provides you with a random preview into a few of Nate‘s analysis results. A few companies are chosen randomly each day.

But I’m more interested in the stock XYZ. Can you please send me all you know about XYZ?

This feature is currently not supported in the Free Newsletter. In the near future it might be available for registered users.

Another feature request: I don’t want to get a lot of results each day. I’d like to wait until there’s a really good opportunity in the markets. Can you filter your results by some risk/return tradeoff?

The ability to receive only the highly significant results, and control risk/return tradeoff, is currently not supported in the Free Newsletter. In the near future it might be available for registered users.